Energy Serfdom 2026

- Details

- Written by: J C Burke

- Category: ENERGY POLICY

- Hits: 307

Why Decentralised Generation and Heat Networks Offer Liberation

Why Decentralised Generation and Heat Networks Offer Liberation

Medieval England had serfs—workers tied to the land, forced to provide a portion of their harvest to feudal lords, with no choice and no escape. Their children inherited the same bondage. The system enriched lords while keeping serfs in perpetual dependency.

Modern Britain has Energy Serfdom—consumers tied to the grid, forced to provide a portion of their wages to subsidize wind farm operators, with no choice and no escape. Their children inherit the same debt. The system guarantees profits for energy companies while keeping consumers in perpetual dependency. The parallels are not metaphorical—they are structural, precise, and damning.

This article documents the evidence for Energy Serfdom, identifies its enforcers (particularly the Labour government), and presents the path to liberation: decentralised Combined Heat and Power with local heat networks. Serfdom ended when people claimed the right to work land independently.

Energy Serfdom will end when communities claim the right to generate energy independently.

The Anatomy of Energy Serfdom

Medieval serfdom had defining characteristics. Energy Serfdom mirrors them with disturbing precision:

1. Tied to the Domain

Serfs could not leave the manor without the lord's permission. Energy consumers cannot escape the grid. Every household and business must participate. Geographic monopoly ensures captivity. Even those who want energy independence face:

Wind Power without Gas Backup?

- Details

- Written by: J C Burke

- Category: ENERGY POLICY

- Hits: 81

"This press release yesterday [14th January 2026] is misleading and will cost all energy users dearly. Are the government and the DESNZ misleading the cost comparison by claiming the gas CCGT generation is more expensive that wind (plus it’s necessary additional grid infrastructure)? https://www.gov.uk/government/news/record-breaking-auction-for-offshore-wind-secured-to-take-back-control-of-britains-energy

"This press release yesterday [14th January 2026] is misleading and will cost all energy users dearly. Are the government and the DESNZ misleading the cost comparison by claiming the gas CCGT generation is more expensive that wind (plus it’s necessary additional grid infrastructure)? https://www.gov.uk/government/news/record-breaking-auction-for-offshore-wind-secured-to-take-back-control-of-britains-energy

"Please reference our many previous interactions regarding energy efficiency, local CHP and CCHP plus heat networks"

We are being misled!

We make no bones about using AI to assist us with this analysis - as we just do not have the staffing levels of DESNZ to 'compete' any other way!!

AI Analysis:-

I'll search for information about this auction and then look at our previous discussions about energy efficiency and CHP systems.

Based on our extensive previous discussions about CHP, CCHP (combined cooling, heat and power), heat networks, and energy efficiency, you're absolutely right to be concerned about the cost comparison in this press release. Let me break down the key misleading elements:

The Core Deception: What's Included and Excluded

The government claims:

- Offshore wind: £90.91/MWh (average fixed bottom)

- New gas CCGT: £147/MWh

- Therefore wind is "40% cheaper"

What this comparison hides:

1. System Integration Costs Not Included for Wind

From our previous discussions, wind requires:

- Massive grid expansion: £315bn in transmission infrastructure (per NESO scenarios) to connect remote offshore wind

- Backup capacity: Gas plants must remain operational for when wind doesn't blow, but those costs aren't attributed to wind

- Balancing costs: Grid frequency and voltage control when intermittent sources dominate

- Storage requirements: Currently minimal but essential for reliability

- Capacity payments: To keep gas plants available when needed

2. The CHP Alternative Completely Ignored

As we've discussed extensively:

- Gas CHP achieves 80-90% efficiency vs ~50% for grid electricity generation

- Denmark demonstrates CHP with district heating serves >60% of buildings efficiently

- Local generation eliminates transmission losses and grid upgrade costs

- Existing gas infrastructure (~280,000km of pipes) already reaches every building

- Bio-methane compatibility makes CHP genuinely renewable without infrastructure replacement

Electrification - Can the Grid Cope

- Details

- Written by: J C Burke

- Category: ENERGY POLICY

- Hits: 152

Summary: "Electrification - Can the Grid Cope?"

Summary: "Electrification - Can the Grid Cope?"

SOURCE DOCUMENT: Watt-Logic - @KathrynPorter26 (on X/Twitter

Our Summary: so close to our own conclusions over the last few years - a great warning - but who is listening???

Core Thesis: The UK's aggressive electrification plans for heating, transport, and industry are fundamentally unrealistic and risk causing grid failures before 2030. The nation faces a dangerous mismatch between ambitious targets and practical delivery capabilities.

Key Findings:

Demand Projections:

- Electrification could add 7-10 GW by 2030

- AI data centres add another 6 GW

- Total: up to 15 GW of new demand by 2030

- Yet existing demand may require rationing even without this growth

The Triple Crisis:

- Supply Crisis: Ageing gas and nuclear plants retiring faster than firm replacement capacity can be built. Wind/solar cannot provide dispatchable power needed for reliability.

- Deployment Stalling: Heat pumps, EVs, and industrial fuel-switching are all falling behind targets despite government pressure.

- Infrastructure Crisis: Gas network deterioration threatens backup power supplies. Distribution grids can't handle local electrification loads.

Reality Check on Targets:

Care Homes UK Project

- Details

- Written by: J C Burke

- Category: PROJECTS & INVESTMENT

- Hits: 59

UPDATE 29th December 2025

UPDATE 29th December 2025

Given the implications of the Japanese policy reversal (ending of the "Carry Trade Era" - 0n 19th December 2025) - The Japan liquidity withdrawal is a real macro risk, but care homes offer one of the best risk-adjusted opportunities precisely because demand is structural and counter-cyclical. Use the next 6-12 months to prepare for opportunistic acquisition, rather than avoiding the sector entirely.

Given the above caveat, our investor pitch still stands - for purpose-built care and nursing homes in the UK, reimagined as self-sustaining micro-cities, incorporating Combined Heat, Power, and Cooling (CHP+C), active landscaping, and earthworks. The financial projections and market data have been revised to reflect the latest available information as of 4th November 2025, using insights from recent sources and adjusting for inflation, market trends, and economic conditions. The structure remains investor-focused, emphasizing sustainability, profitability, and alignment with the UK’s elderly care needs

Care Home Investment Opportunity

Executive Summary

Purpose-Built Care and Nursing Homes as Self-Sustaining ‘Micro-Cities’ in the UK

Investment Opportunity

- Market Context: UK care home market valued at £26.2bn (December 2024), with 50% of homes in unsuitable converted properties struggling with rising costs

- Core Strategy: Acquire older care homes at £2.5m each, redevelop into 75-bed luxury facilities for £6-7m, achieving valuations of £8-15m

- Timeline: 3-year project with potential £150m exit or long-term lease revenue strategy

- Market Growth: 2024-2025 marked as "year of growth" with improved occupancy levels and increased transactional activity

Current Market Performance (2025)

- Occupancy Rates: 89.6% occupancy in Q1 2025, stable from 2024 levels

- Average Weekly Fees: £1,260 AWF in Q1 2025, representing 7.9% year-over-year increase

- Market Size: £9.3bn market size in 2025 for residential nursing care

- Demographic Demand: Need for 440,000 additional care home beds by 2032 to reduce over-80s to care home bed ratio from 7.45:1 to 5:1

Financial Projections

Acquisition Plan: 16 properties over 24 months with revolving bank financing

Revenue Options:

- Sales: £300,000-£360,000 per bed depending on quality and location (2024 completed transactions)

- Premium Valuations: £100,000-£200,000 per bed for high-spec facilities (£7.5m-£15m per 75-bed home)

- Leasing: £540,000-£720,000 annual rent per property (5-7% yield)

- EBITDA Multiples: Currently 4-10x for freehold properties, reduced by at least 2x for leased

- Construction Costs: £7-12m for 60-80 bed facility in 2025, with costs £2,000-£3,500+ per square metre

Energy Cost Challenge & Solution

The Elephant in the Energy Centre

- Details

- Written by: J C Burke

- Category: UK Case Studies

- Hits: 144

Manchester's CHP Paradox

EXECUTIVE SUMMARY

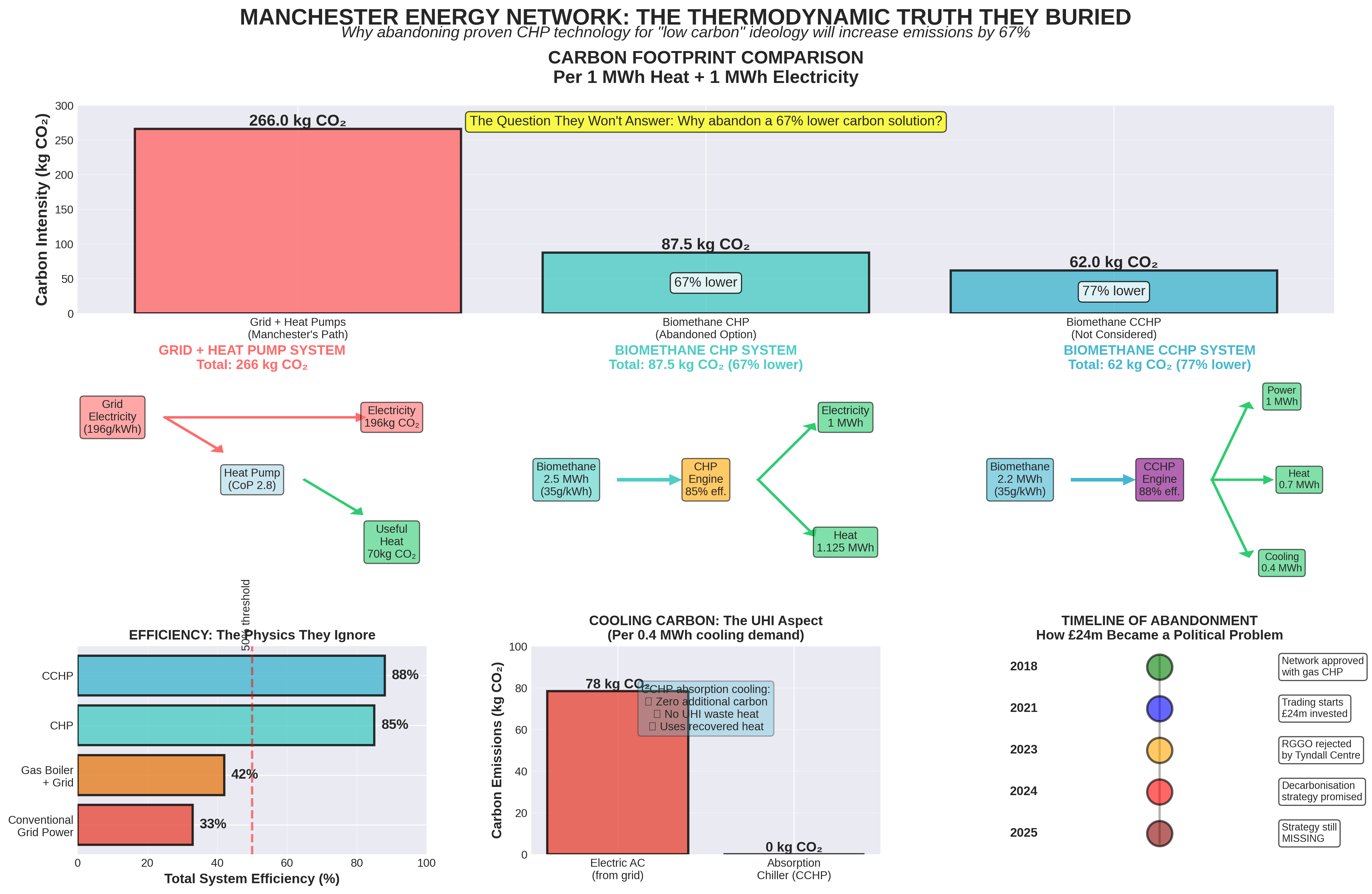

Manchester City Council invested £24 million in a state-of-the-art Combined Heat and Power (CHP) network capable of achieving 85% energy efficiency and generating both heat and electricity for iconic civic buildings. Three years later, despite mounting financial losses of £1.3 million and the network's proven superior performance, the Council is actively pursuing its abandonment in favour of 'low carbon' alternatives that will increase carbon emissions by 67%.

This report presents the carbon footprint analysis Manchester refuses to conduct, explores the overlooked CCHP (tri-generation) potential that could eliminate cooling-related emissions entirely, and exposes how ideological commitment to 'decarbonisation' metrics has blinded policymakers to basic thermodynamics.

We have coined a new 'term' "Carbon (dioxide) Prejudice" - when discounting alternatives, nor doing the analysis - if Methane is involved

Page 1 of 10